FCPAméricas Blog

Overview

History:

The U.S. Foreign Corrupt Practices Act (FCPA) was enacted in 1977 after post-Watergate investigations into corporate political donations revealed payments to foreign officials on a massive scale. In response, the U.S. Congress passed the FCPA to curtail bribery of foreign officials and restore the public’s trust in the way U.S. companies did business abroad. More than three decades later, prosecutions of FCPA violations are common features of international business.

Scope:

The FCPA covers two broad topics:

- The anti-bribery provisions, in general, prohibit bribing foreign government officials. More specifically, they prohibit offering to pay, paying or authorizing the payment of money or anything else of value to a foreign government official in order to influence any act or decision of that official or secure any other improper advantage in order to obtain or retain business. (For more, see the prohibitions section.)

- The accounting provisions include requirements and prohibitions applicable to “Issuers”, i.e., U.S. and foreign companies registered on any U.S. securities exchange. They require Issuers to: (a) maintain books and records accurately, fairly and in sufficient detail to reflect transactions and disbursements of the company’s assets; and (b) devise and maintain a system of internal accounting controls that ensures transactions are executed in accordance with management’s authorization. They prohibit individuals and companies from (a) falsifying the books and records of an Issuer, or (b) failing to implement an Issuer’s internal controls system.

Enforcement:

The anti-bribery provisions of the FCPA are primarily enforced by the U.S. Department of Justice (the “DOJ”). The accounting provisions are primarily enforced by the U.S. Securities and Exchange Commission (the “SEC”). Violations of either the anti-bribery and accounting provisions can result in civil or criminal sanctions.

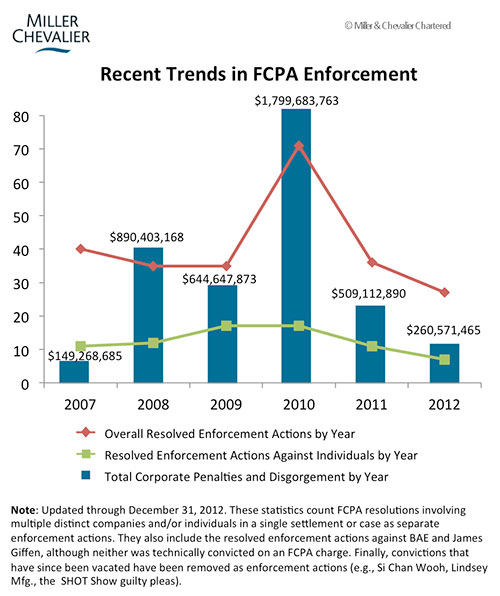

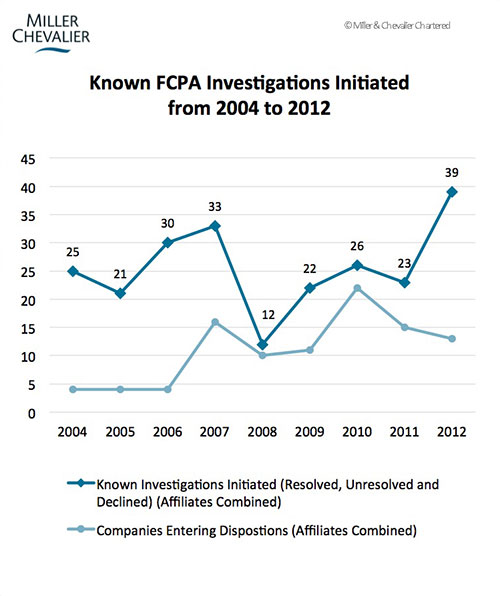

Both the DOJ and the SEC have dedicated significant resources to investigations of FCPA violations. The FBI has established a special unit to investigate these violations, and, in 2010, the SEC was authorized to provide monetary incentives for whistleblowers in FCPA cases. (FCPAméricas has discussed how U.S. enforcement officials discover violations here.) As shown in the following tables, these efforts have resulted in numerous FCPA investigations, multi-million dollar settlements and jail time for executives.

The information in the FCPAméricas blog is intended for public discussion and educational purposes only. It is not intended to provide legal advice to its readers and does not create an attorney-client relationship. It does not seek to describe or convey the quality of legal services. FCPAméricas encourages readers to seek qualified legal counsel regarding anti-corruption laws or any other legal issue. FCPAméricas gives permission to link, post, distribute, or reference this article for any lawful purpose, provided attribution is made to the author and to FCPAméricas LLC.